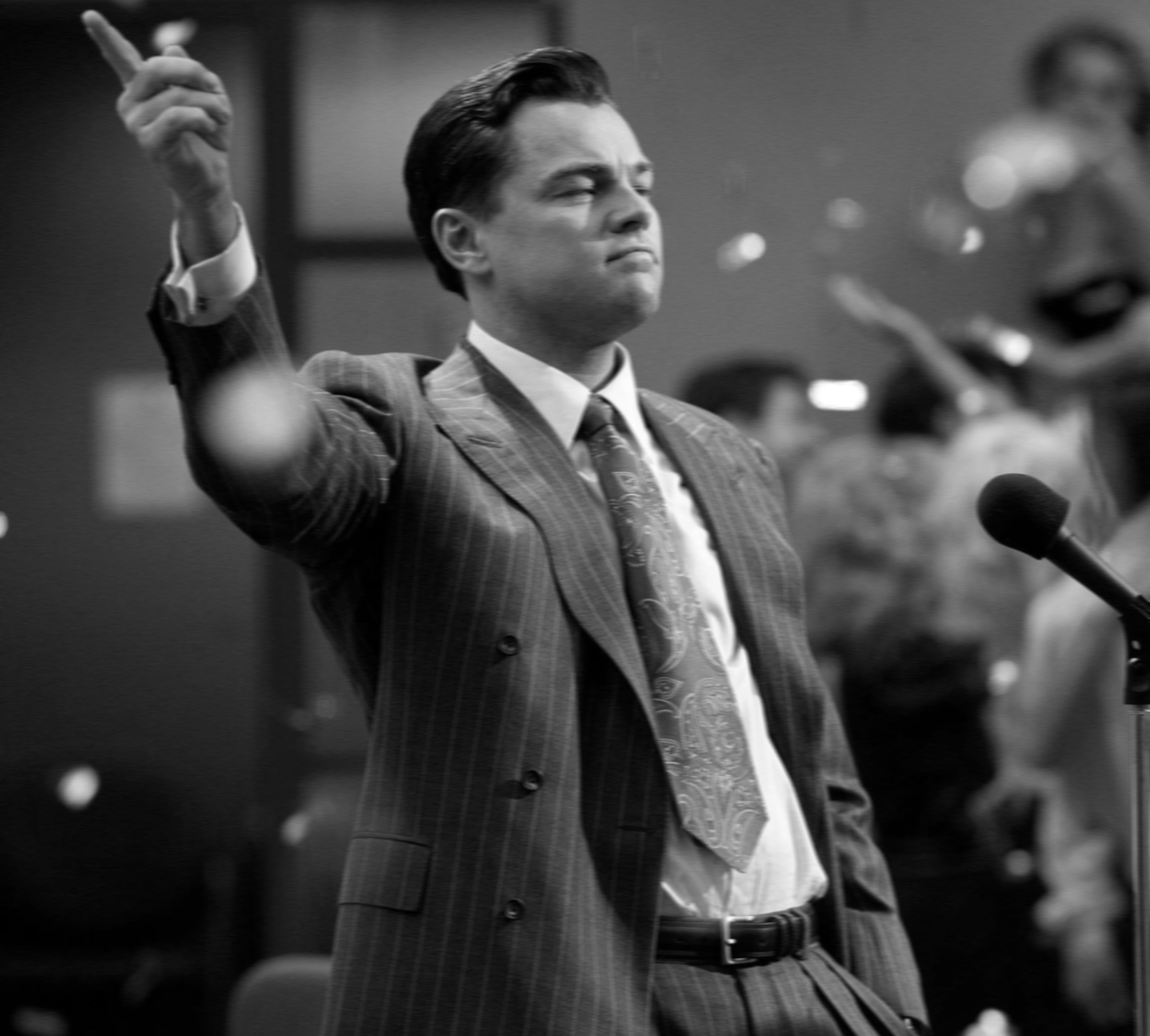

Congrats, we’ve made it out of the sideways price action and are back to trending markets. Euphoria sets in, everyone is a genius again – but remember to stay grounded.

Okay, recent context: BTC has broken out of its months-long range between $50,000 and $70,000 and hasn’t experienced a major correction since the breakout. Price discovery things. This move was mostly driven by institutional interest in the breakout trade, which has proven profitable on the orange asset in the past. Adding to this are enormous inflows through ETFs trading on exchanges since 2023 plus an almost non-stopping TWAP in the billions from Michael Saylor, whose company MicroStrategy – due to its high Bitcoin reserves – is also making one all-time high after another (so far).

But what should we watch out for in those market conditions, where are the risks, and how can we profit from completely untouched price areas? Some food for thought.

You’re not early anymore.

No one will be able to guide you from the bottom to the top, the only one to blame for missing out on trends or taking profits too early – or even worse – round tripping your gains is you. Keep this in mind, this will help you to stay grounded in phases of euphoria where it seems like everyone is a genius once again. In reality, you are not. But this doesn’t mean you can’t justify a long on a blatantly overvalued project or meme coin. Market caps, valuations – all that doesn’t matter in a phase where everyone wants to get onboard. Market participants will be happy to buy the new shiny thing at a valuation that will look absurd a year later.

But how does this work? Longing shit where you know it’s overvalued, but shiny? Well, just be careful that you can’t get blown out – that’s all. Tight invalidations, stop losses at break even when your position is somewhat far in the green. These tools will make your life as a trader much easier. It’s fine to get stopped out 5-6 times – in a bull market you will be fine as long as you prevent big drawdowns. One winner and you’ll be more than fine. Position was in green, getting stopped out at breakeven and now you feel stupid for not taking profits? Not worth it. Just re-evaluate the trade, is it worth taking again – or did you just prevent a full roundtrip from green to deep red? Maybe 2 or 3 times you will regret getting stopped out and markets moving up rapidly again after your stop was taken, but trust me – the one day you will be more than grateful to not lose 20-30% of your portfolio in one candle because of those simple capital preventions.

Do not overleverage. Do not overtrade.

So you caught the bottom on the majors and the top performing alts, all in the green. You feel like you’re the best trader on earth – congrats. Now you increase your position size, because what could go wrong? Those assets won’t reach your entry anyway, right? And then, out of nowhere, your favorite CT Influencer starts yapping about that new shiny coin with 5% float and how it’s going to change the future of finance. You check the chart: +30%. Wow, let’s enter this one as well. Oh, the memecoins are running again. “How stupid was I not to long Pepe, Doge, Shiba, Popcat, Mog, WIF, GOAT and ChillGuy? Yeah, let’s long all of them – I don’t know which one will perform best, but some will certainly do well.”

This is an average evening at your desk during extreme days. You make money, but you feel like it’s not enough and you’re underperforming, so you increase your position sizes. Well, to some degree it’s fine, but just don’t overleverage. Make sure you can’t get blown out no matter what happens. You’ll be fine without big leverage anyway if you’re on the right side of a trade. Nothing hurts more than being right, but taken out by a liquidity flush for no reason. Preserve your capital – opportunities will keep presenting themselves.

Realize that orderbooks are thin as hell.

“Price discovery” means trading at prices never seen before. No Support or Resistance Levels are existent – or matter. No one has a clue where to sell and where to reenter at a dip – and therefore the order books are very thin. This brings the beauty of “non-stopping” rallies to the upside, but also price plummets without any support or buyers stepping in any time soon – down only.

The market can stay irrational longer than you can stay solvent.

I don’t think there is anything left to say to this famous but true quote by Keynes. Past has shown that this is true over and over again – crypto is somewhat the prime example.

Some more food for thought:

2 responses to “Understanding Price Discovery in Crypto”

-

Throughout this great scheme of things you actually secure a B+ just for hard work. Exactly where you misplaced me personally was in your details. You know, it is said, the devil is in the details… And it couldn’t be more accurate in this article. Having said that, let me reveal to you what did work. The writing can be quite persuasive which is probably why I am taking the effort in order to opine. I do not really make it a regular habit of doing that. 2nd, although I can notice a jumps in reasoning you come up with, I am not necessarily certain of just how you seem to connect the details which produce the actual final result. For right now I will yield to your point however trust in the foreseeable future you actually connect the dots much better.

-

Thank you for taking the time to provide such thoughtful feedback on our article. We genuinely appreciate when readers engage with our content at this level of analysis.

Your points about the lack of connection between details and our conclusions are well-taken. You’ve correctly identified that while the writing style may be persuasive, the logical flow and substantiation of arguments could be improved. The “devil is in the details” comment resonates strongly with us.

Finding the right balance between conciseness and comprehensive detail is always challenging – we aim to keep articles accessible while still providing sufficient depth. Based on your feedback, we’ll focus more on connecting the dots and ensuring our reasoning is fully articulated in future pieces.

While Roundtripped is designed as a free platform to stimulate thought and discussion, we do offer more comprehensive, in-depth research papers through Veritas Research (the company behind Roundtripped; website still in construction) – mostly to german clients – upon request. Your perspective helps us refine our approach and better serve our readers across both platforms.

Thank you again for your engagement with our platform. Feedback like yours is invaluable as we continue to improve our educational content.

-

Leave a Reply