Before diving into the current state of crypto liquidity, it’s crucial to acknowledge the context. We’re operating in the immediate aftermath of October 10th, 2025, which marked the largest single-day liquidation event in crypto history. Over $20 billion in leveraged positions were forcibly closed within 24 hours, triggered by a sophisticated exploit of Binance’s collateral pricing mechanism. The technical breakdown is available from @ElonTrades below, but the human cost was severe. Countless traders saw their positions liquidated, many losing substantial capital in a matter of minutes.

This event serves primarily as a temporal marker for our analysis, a stress test that exposed just how fragile crypto markets become when fresh capital stops flowing in. The real story isn’t the liquidation cascade itself, but what it revealed about the underlying market structure. Crypto has entered what Wintermute aptly describes as a “self-funded phase”, a period where price movements are driven by capital rotation within the existing ecosystem rather than expansion from external inflows. In this environment, the game-theoretic advantages of Bitcoin over altcoins become not just apparent, but structural.

Current liquidity channels and their stagnation

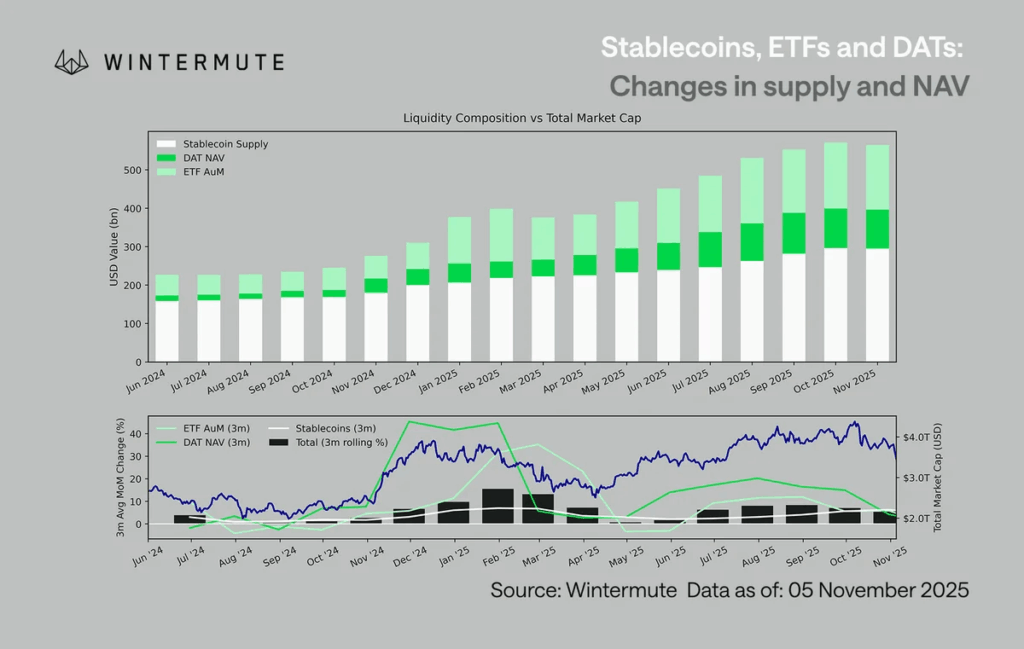

Wintermute’s recent analysis provides a clear framework for understanding how capital enters crypto markets. Three primary channels have historically driven liquidity into the ecosystem: stablecoins, exchange-traded funds, and digital asset treasuries (DATs). Each represents a different investor profile and capital source, yet all three are showing the same troubling pattern.

Stablecoins, the on-chain representation of fiat liquidity, have long served as the barometer for crypto-native risk appetite. When traders and DeFi users are bullish, they mint stablecoins to deploy capital. When sentiment sours, they redeem. From early 2024 through mid-2025, stablecoin supply nearly doubled from roughly $140 billion to $290 billion. Impressive growth, but the trajectory has flattened considerably since summer. The curve has plateaued, suggesting that participants who wanted exposure at current prices already have it.

Digital asset treasuries tell a similar story. These tokenized fund structures bridge traditional finance and on-chain yields, packaging staking rewards and lending returns into familiar investment vehicles. DATs saw robust growth through Q4 2024 and Q1 2025, driven by institutional appetite for crypto-denominated yield. Combined with ETF growth, the DAT/ETF complex expanded from approximately $40 billion to $270 billion since early 2024. Yet here too, momentum has decelerated sharply in recent months.

ETFs represent a more nuanced picture. Bitcoin ETFs have been objectively successful by traditional metrics. BlackRock’s IBIT became the most successful ETF launch in history, demonstrating that institutional demand was real and substantial. However, when examining recent flow data, a relative deceleration becomes apparent. According to Farside Investors, Bitcoin ETF inflows in October 2025 grew from $58.4 billion to $61.15 billion, representing approximately $2.75 billion in net inflows. While this remains positive and significant, the pace has moderated compared to earlier periods. More tellingly, this capital appears to be choosing traditional equity markets over crypto at an accelerating rate, with major indices reaching new highs while crypto consolidates.

The Narrative Rotation Game

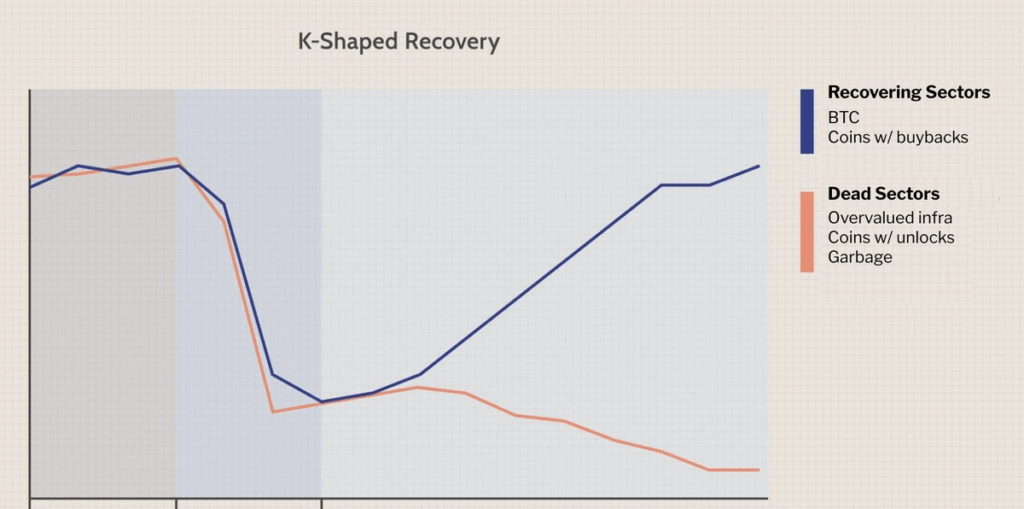

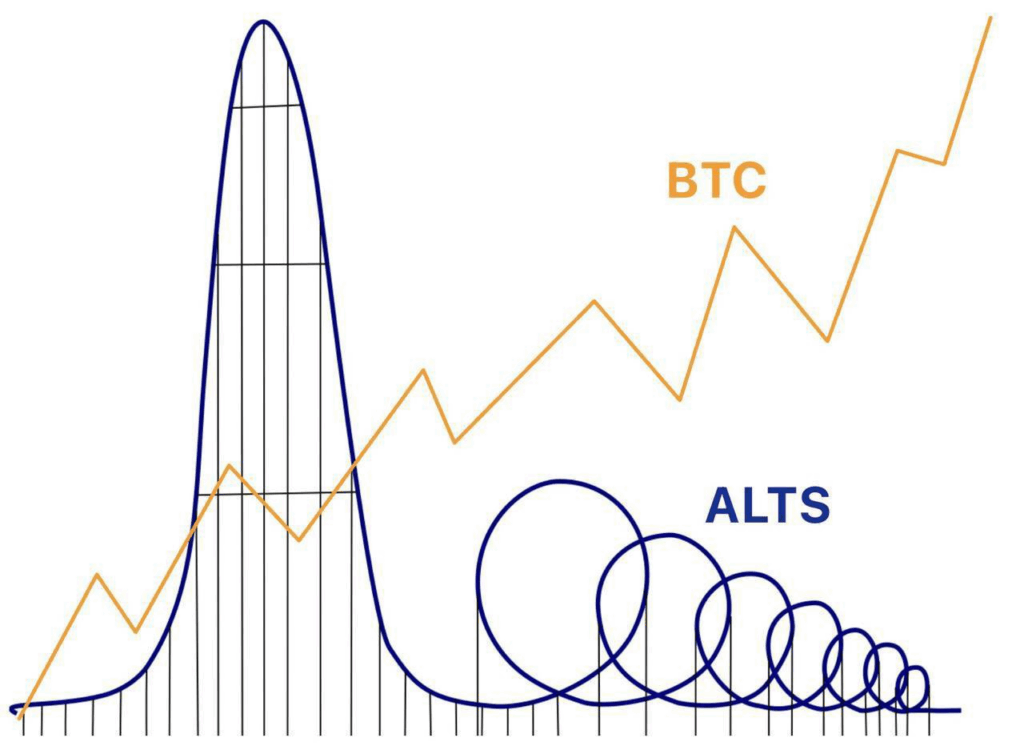

In a self-funded market, the implications are clear. Without fresh external capital to lift all boats, the existing liquidity will chase narratives sequentially rather than simultaneously. Capital will rotate from one trending sector to the next, always searching for the highest short-term returns. Each narrative cycle will likely produce diminishing returns, with lower peak amplitudes and fewer projects reaching escape velocity.

The market has become a finite pool of capital moving between an infinite number of assets, all competing for the same dollars. In this environment, sustained upward momentum becomes exponentially harder to achieve. A handful of projects with genuine utility, strong communities, or institutional backing might maintain relevance. The rest will experience brief pumps followed by slow bleeds as capital moves to the next opportunity. Market cap growth, once broadly distributed, will concentrate in an increasingly narrow cohort of winners.

The altcoin sector faces an additional structural headwind that compounds this dynamic. Many projects launched with extraordinarily high fully diluted valuations, creating a misalignment between circulating supply and total token allocation. As these projects progress through their vesting schedules, gradual unlocks continuously introduce new selling pressure. In a market flush with fresh capital, this dilution can be absorbed. In a self-funded environment, it becomes a persistent drag on price performance. Each unlock event forces existing holders to either accept dilution or compete with insiders and early investors looking to realize gains, further weakening an already fragile sector.

Bitcoin’s Structural Advantage in a Liquidity-Constrained Environment

Despite the challenging liquidity landscape, several positive catalysts remain on the horizon:

- The U.S. government shutdown, now extending over a month, will eventually resolve. When it does, the reopening could provide renewed clarity and positive momentum for risk assets.

- Michael Saylor’s Strategy (formerly MicroStrategy) has resumed Bitcoin accumulation now that $STRC has reclaimed the $100 threshold.

- Global liquidity metrics continue trending upward.

- The 2026 midterm election cycle will inevitably inject fresh volatility and attention into markets.

However, these tailwinds will not lift all assets equally. In a market characterized by finite capital and heightened selectivity, the distribution of gains will be fundamentally different from previous cycles. The broad-based altcoin rallies that defined 2017 and 2021 required abundant liquidity and indiscriminate risk appetite. Neither condition exists today.

Bitcoin emerges as the primary beneficiary of this new paradigm. Its position as the gateway asset for institutional capital, combined with its established role in nation-state adoption and treasury strategies, creates sustained bid support that altcoins simply cannot replicate. When sovereign wealth funds allocate to crypto, they buy Bitcoin. When public companies add digital assets to their balance sheets, they buy Bitcoin going forward. When financial advisors recommend crypto exposure to clients, they buy Bitcoin ETFs.

Beyond Bitcoin, only a select cohort of altcoins will capture meaningful capital flows. Projects demonstrating genuine institutional interest, sustainable buyback mechanisms, or real economic utility stand a chance. Hyperliquid exemplifies this category with its combination of institutional backing, Token Buybacks and protocol-level value accrual. These are exceptions, not the rule anymore.

The coming months will likely validate this thesis. Positive macro catalysts will materialize, liquidity conditions may improve marginally, and crypto will capture headlines again. But the gains will concentrate in Bitcoin and a narrow subset of alternatives with demonstrated staying power. The era of widespread altcoin outperformance has given way to an era of ruthless selection.

Leave a Reply to mxm Cancel reply