A reality check within a bullish environment.

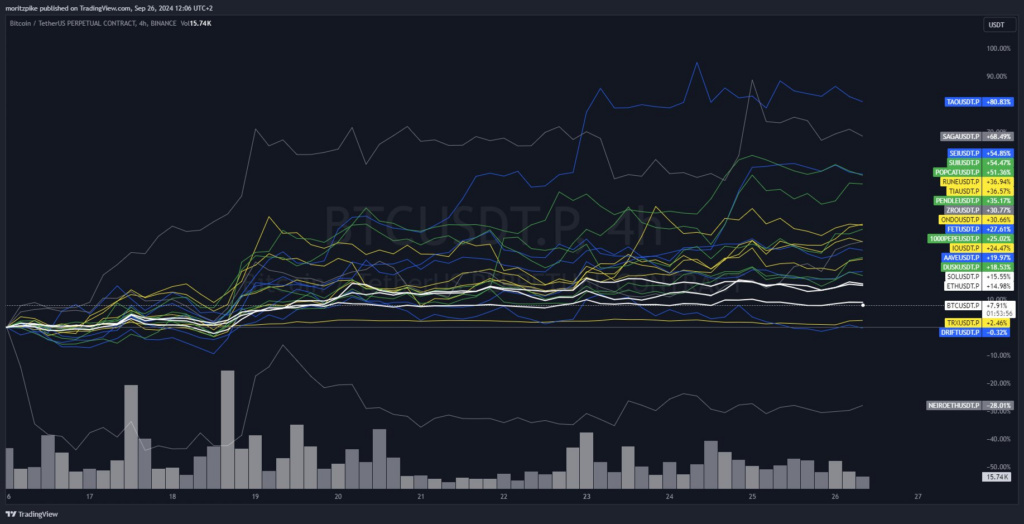

The last days of September were rather favorable for the bulls. Many of the altcoins mentioned in the last article “Altcoin mindshare heading into Q4” managed to make jumps of 20% to sometimes 80% upwards in no time, mostly without significant pullbacks. The idea for this article thus came at the peak of euphoria for all positively minded market participants. Zoran Kole closes his X account at $65,000$/BTC after numerous short attempts, and it seemed as if a new all-time high was being priced in within the shortest time… Pretty much until the start of the highly anticipated “Uptober.”

However, this article aims to discuss, non-judgmentally, some of the perhaps best bearish arguments currently circulating. It’s quite possible that in the future we might see an article called “Some of the better bullish arguments right now” here on roundtripped. We’ll see.

Uncertainties surrounding possible escalations in the Middle East

Wars seem to be part of the business these days, but the latest developments surrounding Israel are worrying and could significantly reduce investors’ willingness to invest in risk assets.

Although the crypto market is used to a quick forgetfulness of crises after a few green candles, market participants from TradFi in particular could see such developments as a reason to sell rather than buy. Data that supports this assumption would be the ETF flows on Bitcoin and Ethereum on October 1st and 2nd. Combined, the net outflows amounted to $335.8 million on the first two trading days of the month (Source: Farside Investors).

FTX Distribution: How much money will hit the market realistically?

According to Sunil Kavuri, an FTX creditor activist, large accounts are “spreading false info” regarding the distribution and the rumored $16 billion inflow. Estimates suggest that around $5.5 billion in claims have been purchased, representing about 50% of total claims. Importantly, these claim buyers are not typical crypto investors and are unlikely to reinvest in the crypto market. For claims over $50,000, initial distributions of 70-100%+ of petition date value are expected in Q1 or Q2 2025. This delayed and potentially significant influx of funds, combined with the likelihood that a substantial portion may not be reinvested in crypto, could create selling pressure and market uncertainty in the coming months.

Could inflation suddenly accelerate again?

The global economic environment is becoming increasingly complex, which may cause some analysts to rethink their stance on inflation. While the possibility of renewed inflationary pressures has not been an issue in recent months, a potential confluence of factors is emerging that could potentially change this outlook. Labor strikes, China’s stimulus measures and simmering tensions in the Middle East all contribute to a more uncertain environment. In addition, the possibility of political change in the US and the potential resilience of the labor market make the situation appear even more complex. Remains to be seen, but would be a 180 degree turnaround that the market has probably not yet been able to price in.

Altcoin market still overvalued?

ETH sitting at around ~$280 billion market cap and OpenAI sitting at “only” ~$157 billion market cap leaves space for some discussions about altcoin valuations and a possible repricement to the downside.

When all is said and done, the bear case always sounds like the voice of reason. It’s eloquent, logical, and oh-so-convincing. But here’s the kicker: in the grand scheme of things, it’s often the seemingly naive bull that ends up laughing all the way to the bank. Logic doesn’t always trump the market’s inherent optimism.

Some more food for thought

Markets can remain irrational longer than you can remain solvent.

John Maynard Keynes

3 responses to “Some of the better bearish arguments right now”

-

Heya i’m for the primary time here. I came across this board and I in finding It truly helpful & it helped me out a lot. I’m hoping to give one thing back and aid others such as you aided me.

-

appreciate it a lot!

-

-

Admiring the persistence you put into your website and in depth information you offer. It’s nice to come across a blog every once in a while that isn’t the same outdated rehashed material. Fantastic read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.

Leave a Reply