Happy new year to all of you!

In this article, we’ll explore two dominant narratives that are shaping the crypto landscape as we move into 2025. While there are numerous exciting developments across the space, we’ll focus on the intersection of AI with crypto and the institutional appetite for sustainable yield – two themes that have shown remarkable strength and staying power.

AI Agents: Your Next Trading Competitor?

No matter where you look or listen, the number 1 topic in business remains Artificial Intelligence. However, what LLMs have embodied so far are primarily models that react to our queries. AI Agents are showing the first remarkable advances in proactive action by artificial intelligence.

How do AI Agents work in crypto? They have access (through API data, for example) to all on-chain transactions, movements/volume on centralized exchanges, current news, and sentiment on social media platforms like X. This enables them to produce well-founded analyses and comparisons, express trade ideas, and in some cases even execute them (example: Managed Fund by AI16z). Now imagine an agent as an employee who notices every movement in the crypto space, analyzes their trades in retrospect in a second-by-second updated journal, evaluates them, and incorporates results into future decisions. The resulting learning curve is exponential, and especially in the crypto space, where you can pick up a lot in a very short time, it probably wouldn’t surprise anyone if we see several agents outperforming 99% of traders/liquid funds in the near future. This potential keeps narratives for coins like $VIRTUAL very current – perhaps still an unnoticed potential by some people.

Sustainable Yield Plays: Ethena, Hyperliquid & AAVE

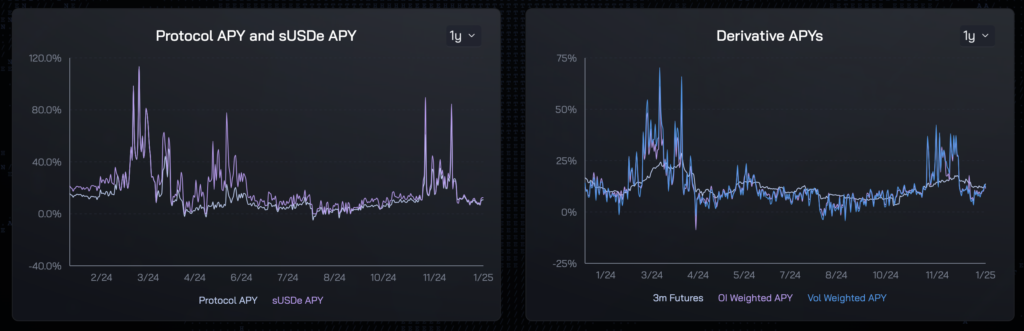

TradFi loves yield on their US dollars. Ethena, mentioned in our Q4 Altcoin Report, emerges as the obvious winner of this narrative, with even the future US President investing in the relatively young project through his DeFi venture.

Hyperliquid has shown incredible success since November, and HL also benefits from the interest in yield – with a slightly different approach. From the beginning, Hyperliquid has offered users on their exchange the opportunity to provide capital for market making and subsequently participate in the profits. The results here also fluctuate depending on market volume, but especially in volatile times, the Liquidity Provider Vault has proven to be an outstanding option for reserves.

Other notable players in this space are AAVE and Pendle. AAVE – currently valued at $5.3 billion – has achieved a performance of 165% since our Q4 Altcoin Report and further emphasizes the point about people’s appetite to allocate profits into supposedly “safer” yield-farming pools.

However, caution is advised here: In the past, we’ve seen plenty of projects fail that advertised high interest rates on the dollar (Anchor or Gemini as prominent examples). Ethena and Hyperliquid offer innovative approaches for this, which although providing fluctuating returns, have the potential to generate sustainable profits on stablecoins in the long term.

There are obviously plenty of other narratives going into Q1/H1 of 2025, but this article should provide insight into the two areas currently most interesting a) for crypto market participants (AI mindshare at absolute peak, according to Kaito AI) and b) for traditional investors around BlackRock & Co. It will be interesting to monitor these narratives closely as they develop. While AI’s dominance in crypto mindshare and institutional appetite for sustainable yield seem firmly established for now, the crypto market’s dynamic nature means new narratives can emerge rapidly. Stay tuned for our next deep dive into emerging trends shaping the market.

Leave a Reply