Bitcoin down 30% from its highs – COVID 2.0?

Comparing the current days to the covid crash would not only be inappropriate but also an admission that one has no idea what they’re talking about. The industry is not on the verge of collapse, and there are currently no doubts that the market will still exist in a few years. The developments in the last 12 months have been too clear: Introduction of Bitcoin ETFs, the world’s largest asset managers have come into possession of cryptos, and regulatory improvements are also on the horizon for the industry, possibly even independent of the election result in September – According to media reports, Harris’s camp is said to have already engaged with companies from the crypto industry and expressed support for a “restart of relations.”

Nevertheless, the thesis that we are in a risk-on environment seems invalidated by this downward move. Support at 60k? Fugazi. The bullish Failed Range Breakdown argument has currently turned into more of a Failed Range Reclaim, realistically speaking.

However, not everything is bad: Moves that happen quickly often offer opportunities, and as an investor, I would personally be much more uneasy if a market believed to be strong would simply bleed down 30% from its high. This has by no means been the case with Bitcoin. Looking at the chart, many of the movements in recent weeks are easy to explain, before we then impulsively broke out of the “ATH Range,” or whatever you want to call it, to the downside in a short period of time:

(1) Germany must liquidate all of its Bitcoin holdings, secured from criminal investigations, due to regulations in a short period of time.

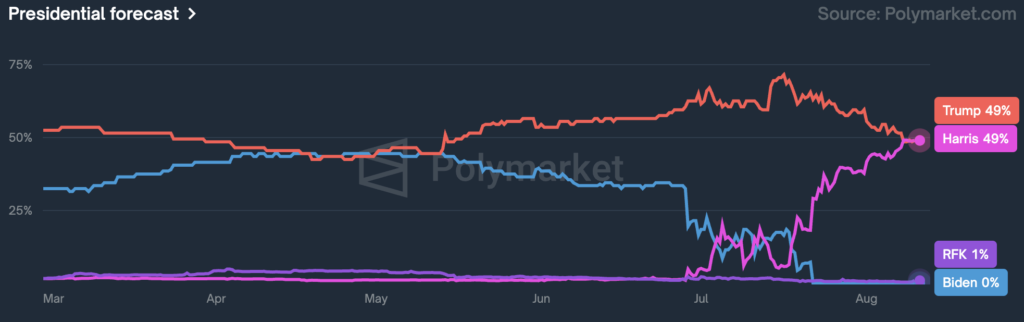

(2) Failed assassination attempt on Trump: The presidential race seems decided, an “Invincible” posing in the style of a film cover against an incapacitated Joe Biden. Trump previously expressed pro-crypto sentiments and is scheduled for a speech at the Bitcoin Conference 2024 in Nashville. The potential vice president is also pro-crypto and Bitcoin. Risk assets rise, and Solana is also one of the top performers during this time (Narrative: With a Trump victory, a Solana ETF would be a matter of time, and the project would securely establish itself in the top 3 of the industry, more on this in the article from the 27th of July)

(3) Joe Biden suddenly withdraws his candidacy. The chances of Donald Trump winning the election decrease again, was the market too hasty?

(4) Trump speaks at the Bitcoin Conference, talks about a possible Bitcoin reserve for the USA. A speech that actually didn’t promise much except that Gary Gensler would lose his place at the SEC and that the USA would not sell any seized Bitcoin in the event of his presidency. A classic speech in the run-up to an election, no more, no less – nevertheless a remarkable turnaround in the statements on cryptocurrencies in the context of politics.

(5) Unemployment figures shock the market, expectations for 50bps interest rate cuts in September are raised, recession fears spread on the stock market.

(6) Jump Capital, Genesis, and other market participants liquidate their assets on this Sunday, August 4th. Into completely illiquid books, the charts look as if no buyers exist anymore.

(7) Japan raises interest rates by 25bps. The Yen carry trade risk enters the next round, all risk assets lose at least 10% of their market capitalization overnight, Ethereum falls by 17% within 5 minutes, for example – price drops that haven’t been seen since FTX and were no longer part of normality in the crypto sector.

“Black Monday”

And now? The market is pricing in an Emergency Rate Cut, as we last saw during the covid crisis, with over 50% probability, the ETFs could see a new volume high on the 1st trading day of this calendar week, and the Japanese stock market is on the brink.

We are facing a time where some market participants will start to doubt their decisions, and no one can really predict with certainty how the markets and current scenarios will play out. One thing seems certain, however: Volatility Incoming.

More food for thought

2 responses to “Bloodbath on illiquid weekends”

-

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

-

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Leave a Reply