Jackson Hole done, rate cuts are coming. The “Q4 narrative” is firing up and some sectors receive a lot of mindshare lately. Consensus: Some inclarity with elections around, but probably higher prices on some assets sooner or later. In this article we will go through current altcoins with notable mindshare.

DeFi (Decentralized Finance) Resurgence

AAVE and DRIFT are leading the charge in DeFi’s renaissance. AAVE, a long-standing pillar of the DeFi ecosystem, is showing renewed strength. DRIFT, as a newer entrant, is capturing attention with its innovative approach to decentralized trading.

PENDLE is carving out a niche at the intersection of Real World Assets (RWA), DeFi-Applications and ETH correlation, often seeing strong bids during market uptrends.

Layer 0 and Layer 1’s

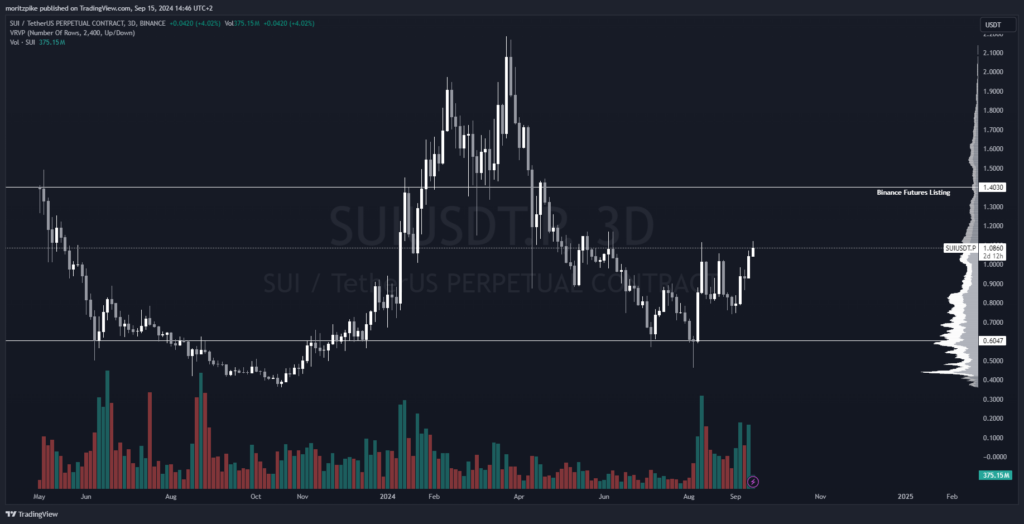

SUI, often touted as a “Solana killer,” remains a top-tier candidate backed by significant VC interest. While it could potentially fade into irrelevance, its current momentum suggests it’s worth keeping a close eye on.

TVL on SEI is also in a strong up-trend, remains to see if the project can grow investors interest in the coin itself.

Memecoins

PEPE continues to hold its position as a top-tier memecoin with strong correlation to ETH. Its large market cap of $3.3 billion indicates sustained interest, and it could see explosive moves during bullish market conditions.

POPCAT is making waves as a popular meme in the Korean market, showing strong correlation with Solana’s performance. Despite its volatility, the absence of a Binance spot listing (which seems inevitable) could spell significant upside potential. Current Market cap lays around $700 million, while the dog with hat trades around a $1.6 billion valuation – the gap is currently closing.

AI myth and Technological Innovation

Are AI coins just digital snake oil, or the next big thing? The jury’s still out. But here’s a plot twist: while crypto’s been doing its “echo bubble or whatever thing”, the AI market has been on a moon mission since 2022, leaving most other markets in the dust. Talk about a paradigm shift – AI’s not just beating crypto, it’s outperforming nearly everything else.

TAO and FET stand out as stronger contenders in the AI-focused crypto space. If we approach new all-time highs in the broader market, these tokens could see significant interest, riding the wave of AI narratives.

If the market topped already there is a chance that the interest in the AI coins could vanish real quick. According to CoinGecko, the AI crypto market is currently trading at around a $24 billion valuation

Real World Assets (RWA) and TradFi Bridges

ONDO, despite its high valuation and upcoming token unlocks, continues to attract attention from traditional finance giants like BlackRock, offering top-tier RWA exposure.

DUSK positions itself as a top tier RWA project, potentially undervalued if the RWA narrative gains traction. Current Market Cap: $100 million.

Ethereum’s Potential Comeback?

While ETH has underperformed relative to BTC and shows lack of inflows through the existing Ethereum Spot ETFs the narrative of an “ETH/BTC revenge” persists. Many believe it’s due for a run sooner or later, though timing remains uncertain.

Further mentions (or: Some more Shitcoins)

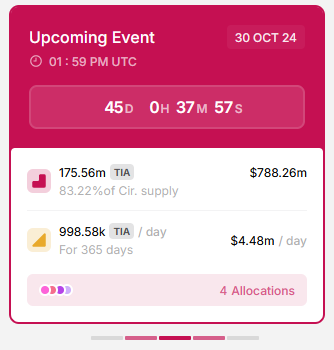

TIA, despite concerns about its high market cap and huge upcoming unlocks, remains a coin to watch, especially considering its strong performance in 2023. A discussion on High FDV Coins, like TIA, from a Venture Capital perspective: Spotify: Market Dynamics, Token Valuations & more.

Upcoming TIA unlocks, starting from the 30th October 2024.

RUNE could see renewed interest in a risk-on environment, particularly as traders seek on-chain leveraging opportunities, which THORChain offers.

TRX, backed by Justin Sun, has seen consistent growth and could benefit from increased inflows, though it is showing some top-signals (recent launch of a trx based memecoin launchpad).

IO, a new entrant on the Solana ecosystem, is garnering attention by combining AI and DePIN (Decentralized Physical Infrastructure Networks) narratives, offering access to GPU performance – tokenomics: low float, high fdv.

SAGA is emerging as a promising EVM-compatible Layer 1, capturing mindshare alongside established players like SUI and SOL. With its low float and new-coin appeal, it’s one to watch in the coming months.

ZRO is gaining attention as a Layer 0 solution, with its low float and modest market cap of $440 million. It’s still flying under the radar for many, but its potential to connect various blockchain ecosystems could see it surge in popularity.

As we head into Q4, these narratives and tokens represent key areas of interest in the crypto market. However, it’s crucial to remember that the landscape can shift rapidly, especially with geopolitical events and macroeconomic factors at play. Always conduct thorough research and manage risk appropriately when considering investments in this volatile market.

Leave a Reply