In the crypto area you will read a lot about how important it is not to be ‘zeroed out’, how important capital prevention is, and all that is true. But how can I be exposed to the upside, but at the same time protect myself from extreme drawdowns in my portfolio in phases where the momentum flattens out and not everyone is a genius?

In principle, there are several possibilities:

Option 1: Stable up.

You could, for example, sell your holdings and be net flat without doing anything but clicking a few red buttons on your exchange. The easiest way of escaping the fear of potential LTF downside.

The disadvantage is that those unrealized profits are no longer unrealized and therefore would be taxable, even though you expect higher prices on this asset in the indefinite future (Important to mention: In this thought experiment, we assume that it is only a temporary equalisation of the positioning on an asset that has a positive expectation in the eyes of the investor). The trade therefore does not sound perfect, but it is possible without further capital contributions.

TL;DR: if you’re selling the local top you are a true genius, saved yourself from roundtripping unrealized gains and will be there with a good amount of cash ready to reinvest to lower prices; if not you will be probably pissed by yourself in the first and pay taxes after (a point which is only negative in countries where there is no potential holding period for tax-free income).

Option 2: Pair Trading

Pair trading is not yet as widespread as you might expect if you look at the volume figures for BTC pairs on the exchanges, for example. Nevertheless, it is a trend that could be of interest to many investors in the space.

First of all, What the hell is Pair/Pairs Trading?

Pairs trading is a market-neutral trading strategy that involves identifying two correlated securities and taking a long position in one while simultaneously taking a short position in the other. The goal is to profit from the relative price movements between the two securities rather than from the direction of the overall market.

The strategy is based on the assumption that the two securities will maintain a historical price relationship. If the price relationship deviates, the trader expects it to revert to the mean, allowing them to profit from the convergence. So the thought process of a pair trader is pretty much: “I have an Asset X and an Asset Y which typically move together, but could get out of sync e.g. after a liquidation event in the markets. Asset X is currently way stronger and therefore expected to catch more bids after the “bottom” was found than asset Y.” In the best case the Asset X is also superior to Y in current market environment as well.

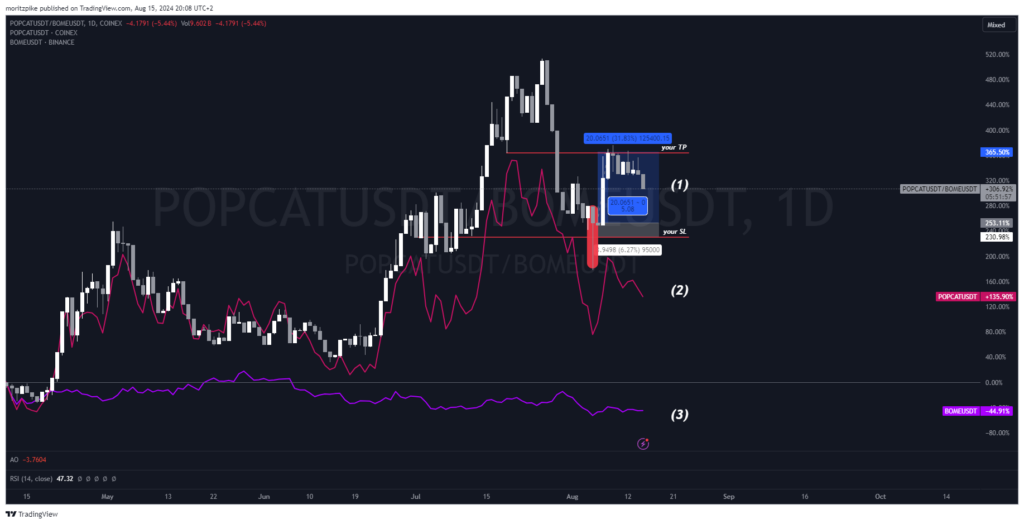

Example of a possible Pair-Trade after recent “Black Monday”

A pair trade I personally took was the trade Long POPCAT, Short BOME (“Book of Meme”). You have the way stronger Asset X with a performance of +80% since the mid of april against Asset Y with a weaker performance of -50% from the same “narrative basket” (in this case: memecoins on solana).

My expectation was that if we bottomed, POPCAT would probably get significantly more bids from the market than BOME. Why should the market care about a coin that is significantly underperforming and getting less mindshare at the time? The 50% correction felt “mispriced”. So I entered this pair trade after the close of the day and was able to close it at the end of the same week for a solid gain of around 30%, simply because Popcat bounced more – topic: different reactions post-cascades, which will be covered on roundtripped in the future as well.

TL;DR: long strong coins, short weak coins can play out sometimes if you fionde a sweet entry.

Option 3: Perp Hedging.

Another way to protect your portfolio from severe drawdowns without selling your spot positions is through Perp hedging. Here, you maintain your spot exposure while opening short positions in the perpetual futures market to hedge against potential downside. The key advantage of this strategy is that you can stay market-neutral without actually selling your spot holdings, thereby avoiding the immediate tax implications that would arise from realizing gains. This approach is particularly useful when you expect short-term downside but still have long-term bullish convictions. When the market stabilizes, you can simply close your short positions and remain fully exposed to the upside without having incurred any unnecessary tax liabilities.

TL;DR: With Perp hedging, you can protect your portfolio against short-term downside without selling your spot positions, thus avoiding taxes while staying poised for the next market move.

Option 4: Options

Another strategy to protect yourself from downside risk while still being exposed to potential upside is through the use of options. By purchasing put options, you can insure your portfolio against significant losses, as these options increase in value if the underlying asset drops. Unlike Perp hedging, this approach requires additional capital, but not on a 1:1 basis, as options can sometimes be relatively inexpensive, especially during periods of low volatility. Additionally, selling call options can generate premium income, providing further downside protection, though it does cap your upside potential if the asset surges.

It’s important to note that options trading is a complex topic, and this explanation only scratches the surface. Understanding the nuances of options strategies is crucial before diving in. If you’re looking for educational content feel free to check out marty’s (@thinkingvols on X) articles on option trading in the crypto markets.

TL;DR: Options offer a flexible way to manage risk and protect against losses without selling your assets, but they require additional capital and come with complexities that should be fully understood.

To wrap things up, hedging in the crypto market isn’t just about avoiding losses; it’s about staying in the game while managing the risks that come with it. Each strategy – whether it’s cashing out, pair trading, Perp hedging, or using options – offers different ways to protect your portfolio.

In the end, there’s no one-size-fits-all solution. The best approach depends on your risk appetite, market view, and how hands-on you want to be. As the crypto space continues to evolve, so too will the tools and strategies at your disposal, making it crucial to keep learning and adapting.

TL;DR: Hedging is about striking the right balance between protecting your assets and staying positioned for growth. Each method has its pros and cons, so understanding them is key to making smart decisions in the ever-changing crypto market.

Leave a Reply